One of the most important things that your Civic Association has done for you.

Below is the story of the civic associations fight against 100% Re-assessment in New York State. Although this fight happened a long time ago it is always relevant as it affects people’s lives every day.

The question that bothers me and the other civic leaders that fought this battle is, is the City obeying the law? In particular we are concerned that the part of the law that says that the sector, that one, two, and three family homes, is protected and insures the balancing off of assessments, cannot pay more than 15% of the city’s taxes. With that sector protection, if assessments rise for some properties then assessments must be decreased for over assessed properties otherwise the 15% State Law would be abused. Who is watching if the law is being obeyed?

It is important that individual home owners should be aware that the Assessment on their home cannot be increased more than 6% a year and not more than 20% in any 5 year period.

You might have seen on TV that Trenton New Jersey has gone through a 100% assessment of all properties and it is a disaster. Homes with Real Estate Taxes of $2,000 jumped to $9,000 one elderly lady’s home went from $5,000 To $40,000 well if it wasn’t for your Civic Association and a union of many civics in our State we would have had that disaster here.

In 1975 a lawyer who lived in Fire Island N.Y. was upset because his neighbor was paying a lot less Real Estate taxes then he was for a similar house. He sued the State and won, what was called the Hellerstein decision. The New York State Supreme Court decided that all properties in New York State should be re assessed to 100% of value.

Our old system of assessing was really a mess, as a home was assessed when it was built and never reassessed. Consequently older houses taxes were much lower than newer houses of the same size. Homes were assessed at 40% of value, and commercial buildings were assessed at 70% of value giving the home owner a break. To reassess all properties in one step would have resulted in the same disaster that Trenton is going through right now. Older people with fixed incomes would have to sell their home as they would not be able to pay the huge Real Estate tax increases.

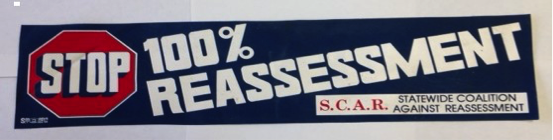

About 1400 New York State Civic associations formed a united association and we called it The State Coalition Against 100% Re-Assessment, or SCAR. We fought a 5 year battle with Stanley Fink who was the “Speaker” of the State Assembly who was for 100% reassessments. For years wherever Fink went, we went, with our signs and voices. We were successful in defeating a Bayside Assemblyman (who was running for re-election) as he was a supporter of Fink and the 100% assessment. That shook Fink up especially when we spoke at a large meeting of a big Civic Association in Brooklyn in Fink’s Assembly district. With that in late 1960 Fink invited us to a meeting in Albany to hammer out a bill.

I said that we were 1400 Civic Associations and yes some of the upstate civics were active but the battle was for the most part, was fought by, State Senator Frank Padavan, State Assemblyman John Esposito, and 6 Queen’s Civic associations who were represented by their presidents. They were the, Queens Colony Civic – Virginia Sallow, West Cunningham Civic – Bob Harris, Bowne Park Civic – John Procida, The East Bayside Civic – Frank Skalla, Auburndale Civic – Jack Norris, and the Bayside Hills Civic – Bill Caufield (not in order of importance). In short we all agreed to the system of very slow equalizing that we have now. Our bill, S.700-a/A.9200 was passed into law in January of 1961. Details on Request.

John Procida 161-09 29th Ave Flushing N.Y. 11358 718-746-5200